According to research, Close to 9 in 10 households today engage in some type of formal or informal financial planning, be it having a comprehensive financial planning or a basic planning,

This, however, is not the main point…

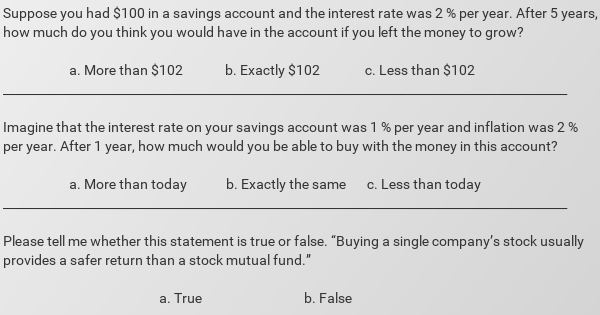

You see, the Questions are, have you ever stumbled across the following questions in your financial life?

These are the few famous questions that the researchers asked in a survey, and surprisingly only about 1/3 of the surveyed could answer all 3 questions correctly.

(By the way, the answer is a, c, and b.)

”Do these had anything to do with me in becoming Rich?"

Well YES, understand about these financial matters and money management would DEFINITELY increase your chance of getting rich and they can lead you to your Financial Freedom, you may be relying a financial planner, friends or family for financial information or financial planning, and please don't get misunderstanding that you shouldn’t rely on these people, but could they help you to do more saving and investing? And ensuring a comfortable retirement?

NO. Unless you help yourself.

Introducing the SPYM Financial Assistant

SPYM Financial Assistant is created on such philosophy, and it can give you a leg-up to achieve something you couldn’t have done alone. Remember, the more you know about financial matters and money management, the better you can do at saving and investing, and the more comfortable your retirement will become. Before I get to show you how SPYM Financial Assistant could save you Thousands of dollars a year and your precious time, the tool will help you to:

- Understanding your needs and goals

- Providing you with relevant, timely information

- Using plain language instead of financial jargon

- Helping you to keep goals on track

- Helping you to create actionable plans

- Helping you to Stress-Proof Your Money

As based on the survey, I know exactly your burning pains when it comes to managing your personal finances,

“To become Debt free…”

“To own a dream car or house…”

“To start earning from investment…”

“To save enough and prepared for unexpected emergency…”

“To build up saving and not to worry about retirement…”

“To make more money while working less…”

Are you getting tired of not reaching your financial goals? SPYM Financial Assistant is here to give you the keys to unlock the Numbers.

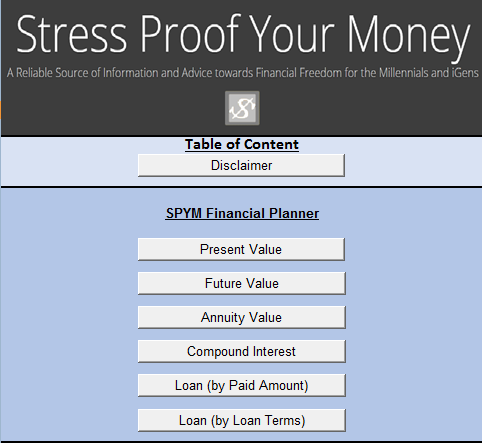

Meet the SPYM Financial Assistant tool, it comes with 6 powerful features:

- Present Value

- Future Value

- Annuity Value

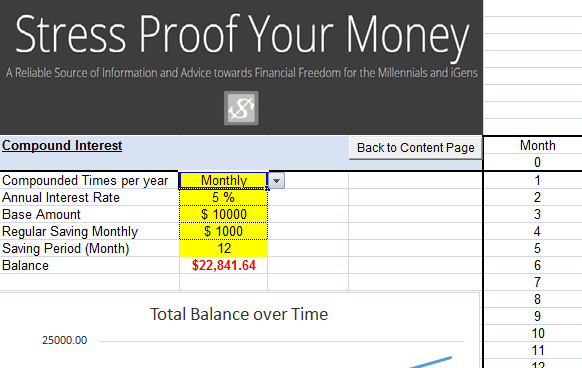

- Compound Interest

- Loan (by paid amount)

- Loan (by loan terms)

“Wait is it just a normal time value of money calculator you are offering?”

First and foremost, it is not a normal TVM calculator. Lots of efforts and man powers had been put into while creating the tool, from researching to coding and testing, as well as result comparison with the actual data from banks. It is not just a calculator; it will become your personal financial assistant over your life time!

- Firstly, the simplicity layout, input, and output, SPYM Financial Assistant is designed particularly for the millennials and iGens, you don’t need to know the every formulation behind. Yes, it is as easy as 1, 2, 3 as it aims to stress proof your finances and not to stress you out! By key in few inputs, and you will get your results straight away, in forms of graphical presentation, with month-to-month’ analysis.

- Secondly, you will get to see the data that the credit card companies or automobile companies don’t want to show you, and information that the financial analyst hoped that you don’t know about and thus doesn’t want to show you, with just a few inputs. It is packed with values and you can unlock the secrets why the rich are getting richer.

- Thirdly, this is not just a simple calculator; it is a tool designed innovatively to help you make sound financial decisions, like selecting your saving account, or picking your first credit card, to purchase your first car or home, SPYM Financial Assistant can help to plan whatever your financial needs.

- Lastly, this is a powerful tool that is GUARANTEE to benefit you a lifetime, it cost a lot from hundreds to tens of thousands to engage a financial planner a year, this tool is made such that everyone could have, whether you are a young graduate or a retiree.

These 6 powerful features will help you in,

Plan your saving goals,

Using the compound interest calculator, you could compare saving rates from different banks, decide how much to put into saving in order to meet your goals, be it short, mid or long term. So you will get to save more of your dollars.

Forecast your investment returns,

Present and Future Value is a calculator, that you could simulate your investment return, be it an asset or equity, you could decide if an amount is invested now or at a later stage, in order to reap a maximum profit. So you could invest with confidence.

Retirement planning,

The annuity value calculator could help you to decide how much of the funds be invested in your retirement account. With this, you could also decide which life insurance is suitable to your needs. So you can put your mind at ease.

Compare the loans, credit cards,

The Loan (by loan terms) calculator will help you to compare different credit card rates, or loans and mortgages. You could take a peek at how much of loans and interest you are paying for different rates. So you can save thousands of dollars from paying interests.

Organize your loans, credit cards repayment,

The Loan (by paid amount) calculator will save your precious time as you organize your budget and plan your repayment. Be it paying in full or the minimum payments or in between, you can see the effect, and how much extra you are paying the bank. So you can clear your debts faster.

And with some imagination, there’re so many things you could do with the SPYM Financial Assistant, Let's see some more example.

If you receive a bonus (enough to clear your debts) from your company due to your hard work today, would you use it to pay off the debts? Will you save the money? Or will you invest it? Or spend it to award yourself?

This is the financial decisions you encountered every day. How would you do? You would get different opinions from different people, still, opinions can be abstract, sometimes you needed a little fact or figure to help. Using the features available, you could then decide where the money be better spent on!

Here’s another scenario,

If you have a variable or adjustable-rate mortgage, and as interest rates fluctuate. Your monthly payments can move up and down, how could you recalculate your payment if the actual rate reflects differently than the original agreement?

This is another problem you would encounter, you cannot predict the market rates (CMT, COFI, or LIBOR). I said earlier that you needed a little imagination, and you could do many things, right? Yes, just right after the fixed rate, key-in the remaining balance and remaining term, and the new rate, there you got it!

This tool will help to save you tens of thousands of dollars in many years to come.

And here are some of the users who had try the SPYM Financial Assistant tool!

…….

“I am at a point in my life where I am looking at my finances more closely, trying to make the best decisions. I want to make smart decisions about my debt, my current financial situation as well as savings and investment. I am at a crossroad and need to start making decisions that will also help clear my debt. So this tool will be perfect. Thanks!” ~Emily G

“You are providing great value here Jeremy. It's also great to see the Millennials get serious about personal finance and money. Well done!” ~Peter W

“This is a fantastic tool. I spent nearly 15 years in the mortgage and financial industry and manually calculating loans, etc can be a real pain. I think you created something really special! I love the forecasting feature! I will certainly have to play around with it. Thank you for sharing!” ~Heather G

…….

Wait there’s more for you.

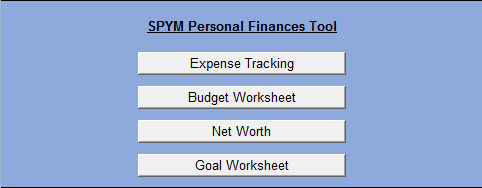

- There are 4 additional features on personal finances that could help to plan your financials. In which include the ‘Expense Tracking’, ‘Budget Worksheet’, ‘Net Worth’ and the ‘Goal Worksheet’, where you can copy and paste freely.

It is a value-packed, this tool can be used in conjunction with the automatic money system, that will prepare you so you are ahead of the game, so you can plan your roadmap to Financial Independent. (Click Here to learn more about the system)

________________________________________________________________________________

________________________________________________________________________________

“The future is defined by what you do today. Not tomorrow.”