Being able to manage your money is a great way to live a more stress-free life.

You may have a lot of bills and owe lots of money every single month. It is easy to catch up in financial stress. But being able to manage what you have is a great way to secure your future and the future of your family. Being able to manage your money is a great way to live a more stress-free life. The first step to managing your money is through the financial assessment. An individual can check his current financial situation by simply analyzing their financial balance sheets and income statements.

A typical balance sheet will consist of personal assets such as bank saving, cars, houses, investments, stocks and personal liabilities such as bank loans, credit card debt, student loans, loans, and mortgages. A typical income statement will list out the incomes (such as your paycheck) and expenses, which help you to determine how much you have each month.

(Click HERE to Understanding Personal Finance)

Budgeting and Managing your money?

You will first need to understand about expenses, write down all of your fixed and flexible expenses and estimate how much the cost will come in each month.

Fixed spending

A fixed spending is something that rarely changes from month to month. It is a fixed cost because you will pay the same amount every time. Some of your projections will be easy: You know what your mortgage or rent payments will be in the months ahead. The same goes for car loans and the premiums or insurance policies. So why budget for them? Because through recording these and other fixed expenditures every month, then you can take a look how much you have spent on your income on current or future expenses. You would have an idea how much of your income left and you can do further planning.

Flexible spending

A flexible spending is something that you can save for. For instance, your food and clothing expenses, they are flexible spending because you do not have to go clothes shopping if you already have wearable clothing. Here you'll keep track of the items over which you have some degree of control. This section is the place to test your cost-cutting skills. Look out for patterns that may signal trouble. If the "miscellaneous" line keeps growing bigger, then it is time to start monitoring your spending.

It is also important to know when to say no when it comes to an expense. Do you really need a brand new headset, or is that just something you would like to have? There are many things that you are already buying that you do not need. If you are suffering and stress with money, you must know when to buy something that you need and when to avoid buying something that you would just like to have for yourself or a family member.

The next thing you will want to do is to take your payroll into consideration. If you do not bring enough money to cover your expenses, there’s when you get ‘headache’. In the circumstances like these, you will need to start reviewing what goes wrong and start getting rid of your problem. For instance, limiting your credit card usage, pay with cash, whenever you can. Cut down your subscription services that pay monthly fees, if you are not using very frequently. When you assess your financial situation, you will be able to find ways to reduce your monthly expenses.

Following the salary, the next thing to keep track of is in your bank accounts. It is a good practice to have both checking and saving accounts. The purpose of checking account will be to use to make regular reductions and deposits so that you can pay off bills and shop when necessary. The savings accounts are places for short-term to mid-term savings, and you can possibly earn some interest in some high-interest savings accounts.

Some approaches are paying yourself first, meaning that putting aside part of your payroll into a savings account each month before you start spending. Savings accounts are normally used in achieving financial goals or in a time of emergencies. For example, if you lose your job, it is important to have some funds to support and pay for your regular expenditure.

In short, the most important practical difference between a checking account and a savings account is that you withdraw money regularly from your checking account but you rarely withdraw from your savings account.

Net Worth, how much do you worth?

The next assessment tool for assessing one’s financial progress from year to year is through the understanding of Net Worth. It is expressed as a dollar amount where it represents your financial health and is essentially the result of everything you have earned and spent up until now.

Calculating your net worth is helpful because it allows you to check where you are financially now, so you could respond and make changes and plan towards your financial goals, whether it's savings to pay off student loans, your dream home or for your future retirement years. It is essential to make this calculation on a regular basis so you can see trends in your overall financial health.

For most people, reviewing net worth every six months or once a year is plenty. Others may find it helpful or motivated by making monthly calculations, this, however, may cause unease and unnecessary panic for certain people. For example, if you had a large credit card bill one month, it could throw your net worth off momentarily, which could throw you off mentally too. So bear in mind that your net worth is not constant, but fluctuates throughout your financial life, corresponding to the changes in income and spending habits.

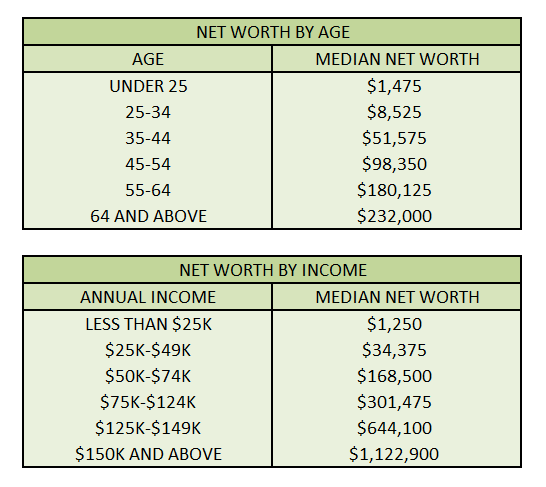

Typically, the net worth of young people (such as recent college grads) is inherently low: as they have just started their career and have yet to earn much income and need to pay for their student loan debt. So worry not if your net worth is a negative number – where your liabilities are greater than your assets. During your working years and as your career advances, eventually your net worth will grow over time as you pay down large debts, start building equities and acquiring more assets.

Nevertheless, your net worth may decrease once you get into retirement and you have no more employment income, therefore it is important to make sure that your Net worth can continue to grow during retirement through various passive incomes from investment or side business. The figure below shows an example of how an individual's net worth might change over time.

By reviewing your net worth, you can find areas for improvement. Reviewing your assets and liabilities can help you develop a plan for paying down debt. Furthermore to keep debt from accumulating, always ask yourself if something you want to buy is a need or a want. Taking a look at your net worth can motivate you to persevere and invest your money. If your net worth shows you are on the track that's fantastic. It can urge you to continue what you're doing.

There is no magical recipe for increasing your net worth, but every time you decrease your debts and increase your assets, your net worth goes up. Growing your net worth is not something that will happen overnight. Like most things, the process takes careful and consistent planning to become a winner.

Learn about Setting of Financial Goals HERE.