You might ask what are the best methods of investing: Lump Sum or Drip Feed. But the truth is choosing the best way to invest really depend on yourself. Also, it depends on your risk profile, So let’s dig deeper.

Check the difference between Active and Passive Investment HERE.

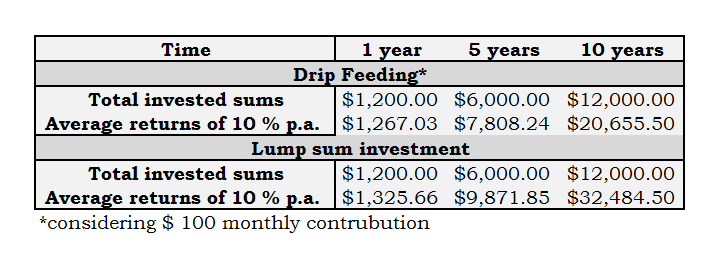

Showing above an example highlighting how both methods of investment can affect your return, based on the term of the investment. We can see that how you time feed your investment could have a huge impact on the returns you receive. This is an important decision, and you shouldn’t be made solely based on how much money you have at the moment. So here are the pros and cons of each method to consider before you make that decision:

Drip Feeding Investment

- Affordability of investment

A common misconception is that most people think they need to have a big lump sum of money to kick-start their investment. This is not true. Some investments allow you to start small. If you don’t have enough money put aside for investment, drip feeding your money on a regular basis is a great choice.

- Lower risk

Drip feed or by investing small, regular amounts are one way to mitigate the risk in volatile investment, especially in the stock market. This is known as dollar cost averaging. The effect of dollar cost averaging is that you’re buying assets at different prices on a regular basis, and not buying at just one price. Hence, the highs and lows of the market will smooth out. You could end up better off than if you invested with a lump sum.

Lump sum investment

- More investment options

There’s a reason why people would choose to invest in a lump sum, this is due to that you can see the result immediately. But this is usually for investors who have a larger investment fund on hand and the confidence in the particular investment performing well. A larger fund opens up a wider array of investments, especially those with higher minimum investment amount.

- Potentially higher return

Investing a lump sum immediately exposed one’s investment to the market and has the greatest potential for growth, lump sum investing is more rewarding in the long run compared to regular small contributions. However, it will also have the greatest potential for loss should the market fall. To avoid exposing their investment to further risks, these investors would practice “investing on the dips” where they set a limit for themselves or what’s commonly known as Value investing.

If however you are confident in a particular fund or stock, and are looking to invest long term, can stomach the volatility and have the money available, due to the potentially bigger gains, investing in a lump sum may sound like a good idea; However to diversify the risk further, most investors would adopt both methods of investment. By diversifying their money between a full investment and regular contributions depending on the type of investment.

Continue to the Commonly used Investment Techniques.