Here are the commonly used investment techniques for different strategies (Click HERE to Active and Passive Management):

Dollar-Cost Averaging

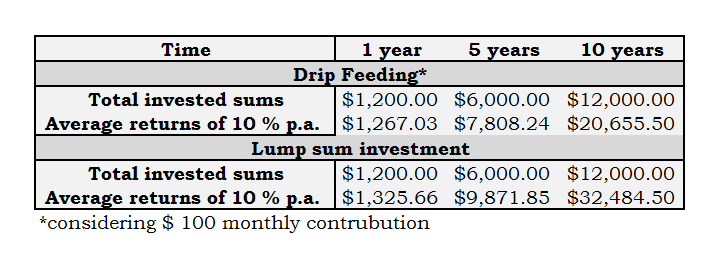

Dollar Cost Average is an investment technique used by investors for reducing the impact of volatility on large purchases of investment products. By accumulating shares in a particular company through investing a fixed amount of money over time, it reduces the risk of incurring a substantial loss resulting from investing the entire “lump sum” just before a fall in the shares.

We call it Averaging because of its potential for reducing the average cost of shares bought. Investors supporting Dollar-Cost Averaging claim that it is not possible to time the market. So by buying fixed amounts regularly, investors end up with some expensive shares, but they could also buy shares at a cheaper price too. They buy fewer units when the shares are expensive, but more units when the shares are cheaper.

However, bear in mind, though, Dollar-Cost Averaging reduces the risk during the downside market, it does not make it the most profitable way comparable to invest a large sum. There are critics that claim that dollar-cost averaging leaves investors worse off when an investment moves up over time. By not investing at the earliest possible time, investors are putting themselves at a disadvantage. That’s because they are foregoing the chance of reaping the benefits of higher returns by not being fully invested as early as possible.

This phenomenon is easily observed in the diagram above. But again, it is very hard to time the market, when do you know a share price is low or high enough? We don’t!

Value Investing

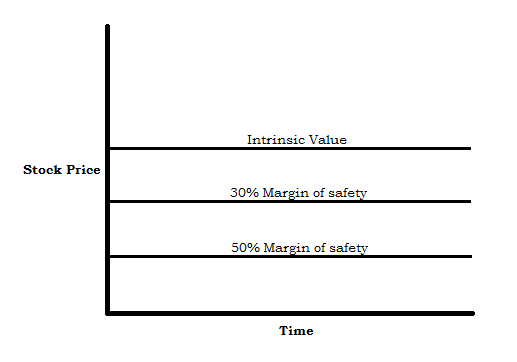

Value investing is one technique to seek companies whose intrinsic value of the company is at a margin of safety or discount. It is a well-worn analogy provided by Benjamin Graham, he who was “the father of value investing”. Graham believed that while value shares may be discounted by the market now, they could go up in price when the true value has been recognized. Value investors assume that over the long-term, a share should reflect the intrinsic value of the company.

By means of fundamental analysis, a true value investor insists on buying companies whose share price is much below their intrinsic values, they first look into estimating the intrinsic value of a company, then comparing the stock price against the intrinsic value of company, if the stock price falls within a reasonable margin of safety, they will buy the shares. In other words, they are looking for a good margin of safety even if it means holding long-term until the price of a great company falls into an acceptable range.

Some value investors try to only buy shares that have margins of safety of 30% or more of their intrinsic value. When the stock approaches or exceeds its intrinsic value, they sell and repeat the process. There are value investors that look for a significant margin of safety that are also willing to pay more for established companies, reviewing a company previously paid dividend history, whether or not the company is profitable, cash flow of the company, and as well as the company’s management.

Growth Investing

Growth investing is a technique that aims to look out companies that have the potential to grow at significantly faster rates than the market or the industry. If a company’s revenue is increasing rapidly regardless of net income, then that company is considered as a growth stock. In fact, a company can have a negative net income, losing money and still be considered a growth stock. Most technology companies fall into this category, some example to name is Amazon and Microsoft.

Growth stocks have the potential to outperform slower-growing investments, such as income stocks. And a growth stock usually does not pay a dividend, a company gains are generally reinvested to achieve further growth and not distributed to shareholders as a dividend. Consequently, growth investors are less bothered about income.

Growth stocks are most appropriate for young and middle-aged investors as they tend to have the highest returns but are also very risky. A faster growth rate could also mean a big downside potential, thus making growth investing much riskier compare other types of stock market investment strategies. Shares in growth companies are highly volatile and, for this reason, growth investing is not suitable for everyone. For an investor who wants to look to generate lower taxed income with potentially lower risk, they should instead go for income stocks.

Income Investing

Income investing is a strategy that focuses on stable, income-producing investments. Many income stocks represent companies that are financially stable and mature, the stock prices of these companies may steadily increase over time while shareholders enjoy periodic dividend payments. And the best dividend stocks pay every year, often on a quarterly basis, some of the best stocks even increasing the amount they pay regularly.

The key to income investing is to make sure that the portfolio of shares is diversified. An income investor would design their portfolio from numbers of high-yield stocks or funds from different industries to generate income at the lowest possible risk. Investors who invest in income stocks also take advantage of the steady dividends and the opportunity to reinvest the dividends to buy additional shares of stock.

Another popular dividend stock is an REIT which stands for real estate investment trust, REIT requires to pay its shareholder majority of its income. Income investing makes a good choice for people approaching retirement as income stocks helped generate passive income from these investments.

Continue to Fundamental Stock Valuation HERE.