When we talked about investment products, what generally come to our mind are stocks and bonds, but the world of investing is definitely a lot more ‘confusing’. But to begin, we need to understand that there are generally 3 levels of investment risk, namely conservative, moderate and aggressive with potential return ranging from 3 percent and up to 20 percent. The most common type of investments from lowest to highest potential returns are government securities, fixed deposits, bonds, investment linked insurances, equities and options/warrants.

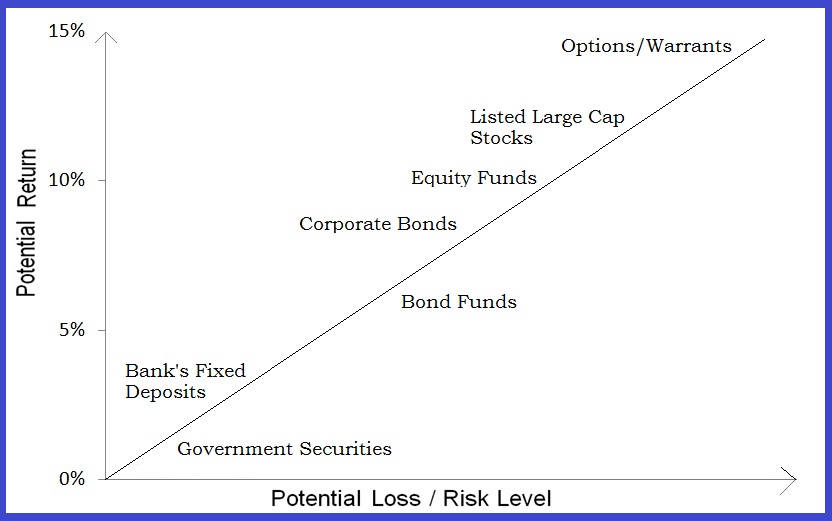

“RISK AND RETURN ARE ABSOLUTELY CORRELATED.”

The chart above illustrates the risk and potential return of the common types of investment products. Such is the fundamental relationship between risk and return, where we always heard that many people are saying high potential returns always involve higher potential risks and there are no low-risk/high-return investments. To have a better knowledge of each product, let’s explore some of them.

Stocks (Equities)

They represent a small ownership in a company or corporate. As a stockholder, you should benefit over time when a company’s profit climbs; and lose if the company is making a loss. Stockholders may receive a portion of profits or dividends, which are usually paid quarterly. A stock may go up or down based on disclosures by the company, news about the industry, or on a broader world events and the economy.

Bonds (Fixed Income investments)

They are a kind of long-term debt issued by companies and governments to the investor to help fund their operations. Bonds are interest rate that pay, which also known as the coupon, and the year the debt matures or comes due. Bond prices and interest rates in the marketplace move in opposite directions, with prices rising when interest rates fall and prices falling as interest rates rise.

Mutual funds

They work by pooling funds from lots of investors and give the investor the chance to invest in a much broader portfolio of investments that would be otherwise impossible to put together on their own. They can come in a number of kinds, ranging from index funds, bond funds, equity funds or balance funds. Mutual funds are priced based on their net asset value that fluctuates along with the investments.

Exchange-Traded Funds (ETF)

They act like mutual funds, but mimicking a stock or bond index or specializing in a sector, like finance or technology. They are designed to generate fewer tax liabilities resulted in a lower expense than mutual funds. The biggest difference between an ETF and a mutual fund is that you buy and sell an ETF like a stock at any time of the day.

Always remember that different products would have one or many types of investment risk associated, such as

- Credit risk– the risk that a company’s credit quality could wane and you, as a stockholder could lose some or all of your investment.

- Inflation risk– Your portfolio’s real return (the return you get after deducting inflation) can be much less than its nominal (pre-inflation) return, especially over longer time periods.

- Maturity risk– longer-term bonds have more risk and price volatility than shorter-term bonds.

- Market risk– this is the non-diversify risk inherent in any securities market. If you own a stock, and the stock market as a whole go down, your stock will likely go down with it.

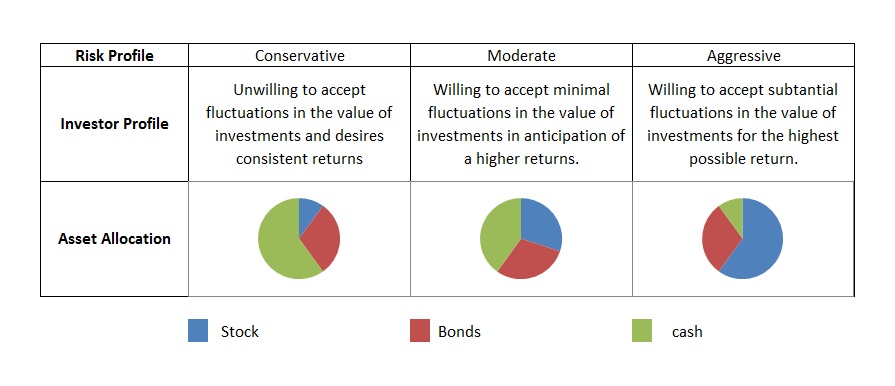

There’s lots of information around should you be interested in exploring more on the different types of investment products. Just bear in mind that when you are seeking a higher potential return, often the risk will be greater. It is important to allocate and diversify your investment portfolio based on your tolerance for risk. Check out the different types of risk profile shown below.

This explained the importance of mixing different investment products in portfolios. Imagine this as a balanced diet, you got to have meats and veggies in your meal! You wouldn’t want your portfolio made up entirely of stocks; a mixture of bonds will reduce your overall risk. But then your age does matter, a younger investor is recommended to own a portfolio that is heavily weighted toward stocks, since his greatest asset is his future earning capacity, in contrary for a retiree, as there’s a limit to their earning capacity, they would prefer a stable conservative portfolio over an aggressive profile.

What is Active and Passive Management in Investment? Click HERE.