A financial plan is basically a blueprint for reaching your financial goals.

A financial plan will detail and list down the precise steps involve in achieving your financial goals. Examples of steps may include increasing one’s current income, investing in real estate, reduction of expenses or setting up another income stream.

Check How to Set Your Financial Goal HERE.

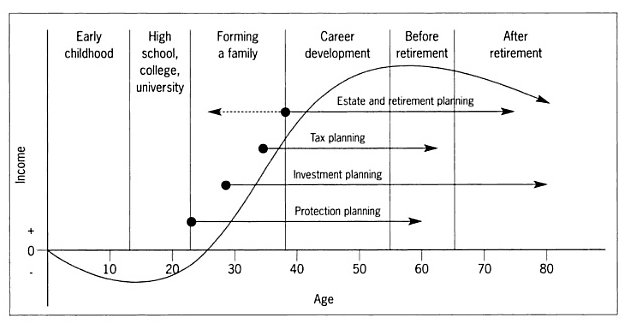

Generally, there’s a series of events or stages where a person will go through during the lifetime, or what is known as the life cycle of personal financial planning. As shown in the figure below:

This life cycle pattern applies for you and me, although the amount of time it takes to move through the financial life cycles varies for every person, but typically there are 3 major stages during one lifetime:

- Wealth Protection

- Wealth Accumulation

- Wealth Distribution

Wealth Protection Stage

This is a stage whereby you focus on building financial security; it is the early working years when you are developing your career and your largest financial burdens are likely the costs of college, a mortgage, and maybe supporting a growing family if you are married.

During these years, it’s important to set up an emergency fund. As discussed before the saving of emergency funds is around 3 to 6 months, and this fund is for your own insurance if you lose your job or suffer an unexpected event like health problems or accidents. It is a good practice having an emergency fund during your work life, but you can cut and eventually drop this fund as you near the later stage of life.

During the early working years, and the fact that you have long worked years ahead, and that you also have significant future expenses. Therefore, you should prepare for the unexpected with health, life, and disability insurance. This will protect you and your family from extreme financial hardship if any misfortune happens. Once your life situation changes (e.g. When you get married), it is worthwhile to revisit the insurance plan and make sure that it covers the more needs in your life.

Wealth Accumulation Stage

Wealth Accumulation Stage, you will focus on the creation and building up of wealth or assets and maximizing your net worth. At this stage, you will need a proper allocation of your excess cash and savings in the right investment vehicles to help you meet your various goals in life.

Typically accumulation occurs early in your career where you first enter the workforce and for the first few years afterward. Your net worth is likely quite small due to limited excess cash. It may even be negative if you have high levels of debt from student loans, home mortgage, or car loans. Your priorities will be paying off these debts.

But beginning to invest for long-term growth and retirement is as important, while you may not have significant savings, starting to invest as early as possible is best. You could start up small and in long-term period, you have a greater chance of riding out the ups and downs of high volatility investments that offer greater potential returns.

As time goes by, and as your family grows, your earnings may grow, but you will also have more demands on your income than ever. Family related expenses, for instance, home purchases or improvements may all overshadow your plans for saving for retirement. Hence, it is also crucial to understand about tax planning.

Why is it so? It is an exercise undergone to cut tax liability through the best use of all available allowances, deductions, exclusions, exemptions to cut income and capital gains. Tax planning is one reason investments such as Individual Retirement Accounts (IRAs) are so important to many people who are saving for retirement. Assets in a traditional IRA can grow tax-free while the assets stay in the account.

You should continue to maximize your pre-tax savings potential by taking full advantage of your employer-sponsored retirement plan such as the 401(k). There are also voluntary schemes like Supplemental Retirement Scheme that will allow for investment options such as stocks and bonds. This can make a major difference and impact on your standard of living in the future.

Wealth Distribution Stage

Wealth Distribution stage is the third financial life cycle phase, achieved in your 50’s and early 60’s, but it could start earlier depending on your wealth. This phase occurs when you realize that you can spend money on things you never thought possible when you are young. For example, spending money on extravagant vacations, purchasing a luxury home, paying for a child's school education.

People in this phase have excess cash flow, high net worth, and low or even no debt. People in this phase are also very aware of the financial risks and have established security against losses. It is in this phase where people had the Estate and Succession Planning: that involves dividing your assets and its implications on taxes, and how you wish to have them transferred or allocated to other parties. You will also analyze wills, trusts, gifts and other means of estate items. Thus, lawyers and accountants typically feature greatly in these plans.

At this phase of planning of wealth distribution of retirement, it involves projecting income growth, estimating the returns of certain investment instruments, planning the amount required to support a certain lifestyle after retirement. This is to make certain that your lifestyle will not suffer once your income stops.

Bottom line

It is important to note that it is quite possible that one will stay in more than one phase of the lifecycle at the same time. It is also worth noting that each phase relies on the earlier phases, meaning that the gifting and distribution phase cannot be achieved unless the person has gone through the asset accumulation phase and conservation and protection phase.

So if you’re in your 20-some and feel like cash flow is tight, just know that you aren’t alone. It is a normal part of the lifecycle phases. The most important part is to forecast every dollar you have come in and begin building your assets so that you can enjoy the other two phases of life much sooner!

Continue to Execution, Periodic Monitoring and Reassessment of Financial Plan HERE.