The answer is YES, and the approach is rather simple. Just invest in an index fund such as S&P500 index by Dollar-Cost Averaging (DCA) approach!

So for you to get some idea, S&P500 since its inception until today would be approximately 10%. But we have to factor in the inflation, so let's just assume a conservative average annual return of 7%. The key to profit actually lies in the compounding effect and with re-invested dividends.

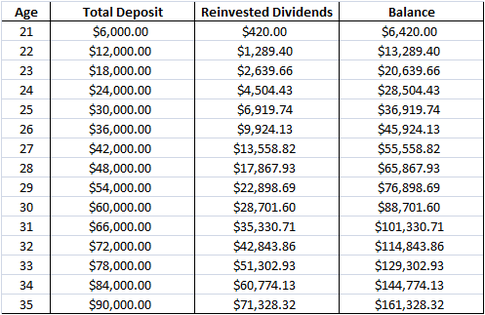

Say you start to invest at age 20, and invest $500 per month for 15 years, here's some hypothetical result you would get.

You will be investing a total amount of $90,000, but your total balance had accumulated to $161,328!

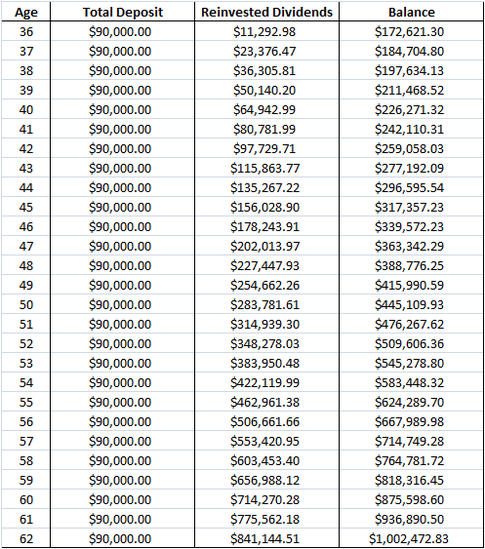

Now, it doesn’t stop here, you might stop funding it further, but it will continue to grow.

You will hit a million milestones at age 62 with only $90,000 invested!

Now my question to you, will you persevere enough to stick to the plan and not panic out in the event of a market crash?

Here's a little tool for you to monitor your portfolio should you be interested in investing in index funds or ETFs, you can download it HERE,